Since I began writing my column for Puck, I’ve been inundated with feedback about Wall Street’s biggest characters and concerns. I’ll be engaging with some of those questions here—in addition to a few observations of my own.

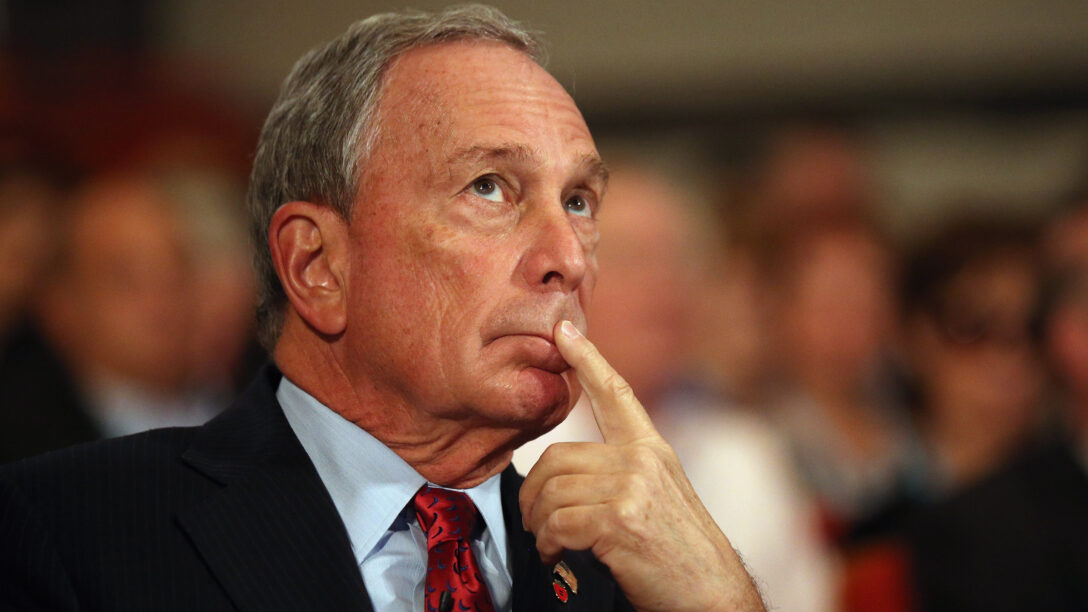

WWBD? (What Will Bloomberg Do?)

You reported this week that Bill Ackman had been interested in acquiring Bloomberg L.P. via his S.P.A.C. Do you think Mike Bloomberg would ever sell his empire? I.P.O.? Leave it to a trust?