|

|

Welcome to Dry Powder. I’m William D. Cohan, coming to you from Hancock Park, in Los Angeles, where I’ve been visiting with family some of Puck’s West Coast all-stars. What a blast!

Tonight, why Wall Street has turned on David Zaslav’s WBD leveraged buyout… and why I still see the bull case for Zaz to turn it back around.

But first…

- What Marc Rowan sees in Paramount: Is Apollo Global Management back at the Paramount Global trough, as Axios reported on Tuesday? My usually chatty sources at Apollo have gone quiet on the topic, which I take as confirmation, oddly. But if it’s in fact true that Apollo has been in touch with the special committee of Paramount’s board, I wouldn’t be the least bit surprised. I’ve been predicting for years now that Apollo would be a clever suitor for Paramount… but at a price that many Paramount shareholders, including the Redstones, wouldn’t like.

At Apollo, after all, buying businesses at the right price is everything. As I’ve reported before, Apollo owns a string of local television stations across the country and would probably be happy owning CBS and getting access to its powerful, if dwindling, cash flow. It would, of course, shutter the money-losing Paramount+ (more on that below) and probably sell off the movie studio to the highest bidder—David Ellison?—in some clever, tax-advantaged way.

Anyway, the fact that Apollo has been in contact with the board’s special committee, which is being advised by Centerview Partners, is telling. It’s not trying to buy NAI, the Redstones’ holding company, nor is it likely going to try to buy all of Paramount. Who would, especially with its $14 billion of net debt? Instead, I suspect, Apollo is trying to pry only what it wants out of Paramount Global, just as I suggested Ellison do with the studio. Will it work? Who knows? The main problems I see with the committee agreeing to sell Paramount assets piecemeal is how to get a fair price, and how to solve the tax consequences of selling low-basis assets for cash. If anyone can solve those two conundrums, it’s probably Apollo, but it still won’t be easy, or maybe even possible.

|

|

| Is the Zaz Correction Coming? |

| In two short years, David Zaslav has gone from the toast of Hollywood to its favorite villain—the caricature of an overpaid, wannabe mogul who can’t see past the next quarter’s earnings. With the restrictions of WBD’s original Reverse Morris Trust structure set to expire, can he rewrite his script? It all comes down to debt maturities and Max. |

|

|

|

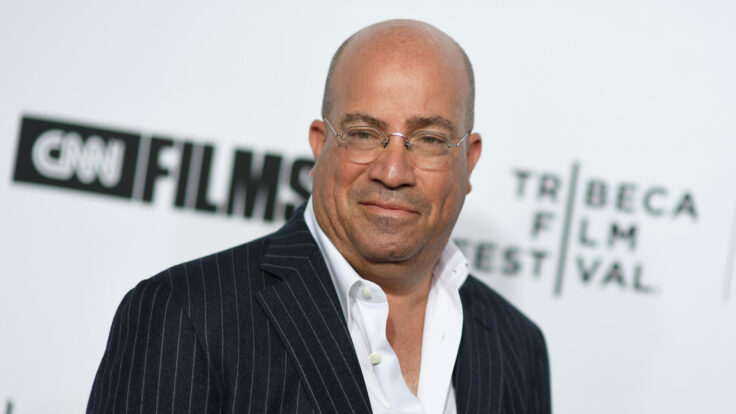

| There’s a lot of talk these days, both on Wall Street and in Hollywood, that David Zaslav’s days at Warner Bros. Discovery may be numbered, just in time for the second anniversary of his blockbuster deal merging Discovery Communications with WarnerMedia. The passing of the two-year milestone is crucial to Zaz’s ambitions, of course, because it liberates him and his company to do other big deals—Paramount? NBCU?—without having to worry about triggering the Reverse Morris Trust tax consequences.

The anniversary, which arrives next month, has been much anticipated since the genesis of WBD. But no one ever conceived back then that Zaz would be in this sort of predicament. After a year spent charming everyone in town before the deal closed, Zaz employed a series of ruthless financial tactics in an industry where executives tend to grinfuck one another, provide soft landings, and worry about optics. Making matters worse for himself and his investors, as he killed some projects and disappeared others, he has failed to keep his promises to Wall Street.

And there have been consequences. The WBD stock is down 35 percent in the last year, 22 percent so far in 2024, and some 62 percent since its debut. Zaz and Gunnar Wiedenfels, his eagle-eyed chief financial officer, guided investors (and the market) to an EBITDA target of $14 billion for 2023 and then delivered a mere $10.2 billion, a sizable 27 percent miss. Remember, the $14 billion target was floated at the time the deal was first announced, in May 2021, and well before it closed in April 2022. Sure enough, during the next 18 months or so, the EBITDA projections turned into “adjusted EBITDA” projections and the predictions slowly sank over the Hollywood Hills, like a glorious L.A. sunset. Investors don’t like EBITDA misses of that magnitude, and like “adjusted EBITDA” misses even less, especially when a company is saddled with extraordinary levels of debt.

True, WBD now has just under four times leverage. And the $55 billion debt pile Zaz assumed on day one has been successfully reduced by $15 billion—no small feat—but he’s still got $40 billion left. The markets also rejected the trial balloon of a potential combination with Paramount Global, which was reported a few months ago by Axios, and subsequently sank both stocks.

Zaz’s standing has deteriorated to the point that agents, producers, and executives are counting down the days until his bonus is reported so they can revel in the schadenfreude, or wonder why he still gets paid so much. Many people, perhaps not surprisingly, suspect that Zaz might be on a shorter leash than he’d like as WBD’s principal shareholders, John Malone and Steve Newhouse, watch their positions shrink in value.

I’m not one of them. I’m a Zaz believer, actually. In fact, I think Hollywood is letting a preferred narrative obfuscate a series of more complex financial realities that many journalists, agents, and rivals—even the financial markets—are missing. In my estimation, there are a lot of good things going on at WBD. (This is not investment advice.) And yes, the market is still, correctly, in a wait-and-see mode when it comes to WBD. Shredding the EBITDA numbers along with the talk of dancing with Paramount spooked investors, who rightly want more evidence of progress before buying the stock and the Zaz story. But I also can see some green shoots at WBD that perhaps the Toscana crowd cannot.

|

|

|

| For starters: Yes, Zaz and Gunnar still have to deal with $40 billion of debt, but that debt pile, while sizable, by and large has long-dated maturities. On your behalf, I studied the company’s debt-maturity schedule. WBD actually has $700 million of debt maturities due this week. Beyond that, however, most of its debt has maturities in the late 2020s, 2030s—even a $3 billion debt repayment due in 2062. So while WBD does have a lot of debt, the bulk of it comes due between 2030 and 2062, and is fixed at relatively low interest rates.

Given that WBD is generating around $6 billion in annual free cash flow these days—compared to Netflix, the market standard-bearer, which generated nearly $7 billion in free cash flow in 2023—and has already paid down $15 billion of debt in 20 months or so, I think the company’s debt story is rapidly becoming a positive one. It’s still on the BBB cliff, mind you, but rapidly moving away from the edge. In the end, I think the fear of reloading WBD’s debt is one of the many reasons that Zaz will have no choice but to resist a deal for Paramount and its $14 billion in net debt and shrinking EBITDA. (It’s also the key reason that investors slapped his wrist for even potentially considering it.) The combination of two highly levered companies with EBITDA challenges is simply not a good look.

Obviously, Zaz’s biggest challenge is ramping up the company’s profitability. I get the sense from my various conversations around Wall Street that WBD is at an inflection point on that front. If WBD’s direct-to-consumer business (a.k.a. Max) is truly EBITDA/adjusted EBITDA breakeven or slightly positive with its 100 million paying customers, as the company reported in 2023, that performance should only improve as more content comes online, churn is reduced, and subscribers increase. Yes, yes, that alleged “profit” in the direct-to-consumer division included money generated by HBO fees from pay TV operators and from licensing shows to Netflix. But WBD is nearly there, and there will likely be a multiplier effect once its streaming business gets sustainably more profitable. Netflix’s price-to-earnings ratio is 50, meaning that every dollar of earnings gets valued by the market at 50 times that one dollar. Even if WBD doesn’t get that same explosive P/E ratio, there is little question that investors will reward WBD’s growing streaming profitability with a higher multiple than its slower-growing traditional businesses, assuming the profits are real and sustainable.

And it’s not crazy to think that will happen. I doubt there is much argument these days that Max will be one of the survivors in the streaming wars. It’s probably safe to say that Paramount+ is doomed in this landscape. Either the new buyer will close it down or Bob Bakish, if he survives the call from Rich Greenfield on Monday that he should be fired, will have no choice but to close it down. One way or another, Paramount+ is gone. And what about Peacock? That might be the other casualty of the streaming wars, despite its bold gamble to spend $100+ million on the rights to stream an NFL playoff game. Layoffs in its marketing department have been steady during the last few months. It’s increasingly clear, at least to me anyway, that Netflix, Disney+, Amazon Prime, and Apple TV+ will be the survivors of this platform shift. There are obviously plenty of known unknowns, such as whether some subgrouping of these companies will bundle their content to better compete. (Perhaps the success or failure of the Spulu sports bundle will dictate the direction…) Either way, WBD has the content and studio to compete, as does Disney, while Apple and Amazon have bottomless pits of capital, likely making them long-term survivors as well.

WBD is now spring-loaded for success, but the keys to getting there remain paying down more debt and increasing EBITDA by making its streaming business much more profitable. If Zaz can get Max’s profitability even remotely close to Netflix’s profitability, I think he’ll have a winner on his hands. Whether he will have a $60 stock, too, is another matter. How CNN fits into all this, I leave to my partner Dylan Byers to assess, but Zaz has unfailing confidence in his new team of Mark Thompson and Alex MacCallum, and he now needs the business unit’s roughly $800 million in EBITDA more than ever.

Can Zaz still mess things up? Absolutely. All it would take for that to happen is for him to re-engage in the silly Paramount Global auction process in a serious way, unless of course he’s the one standing there to pick up some valuable pieces when the rest of the company falls apart, as it appears could very well happen. (Perhaps Zaz should be in touch with Apollo?) That would make Zaz doubly a winner and in a much stronger position to negotiate a deal with Brian Roberts for NBCU after April.

Say what you will about Zaz, but at 64 years old, he’s seen a thing or two and was mentored by two of the savviest businessmen in our lifetimes, Jack Welch and Malone. To count him out would be a big mistake. He’s also made himself nearly irreplaceable (at the moment) as the occupant of Jack Warner’s old desk. Those hoping for his near-term departure are probably forgetting that both Malone and the Newhouse family have too much riding on Zaz and his success to push him out, or to let him go. Changing C.E.O.s at this precarious moment in WBD’s short history would spook investors even more than giving Zaz the chance to finish what he started. It’s hazy, but I can still envision him writing his Hollywood ending.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

| Kamala Comeback |

| A candid, one-on-one conversation with the V.P. |

| PETER HAMBY |

|

|

|

|

| TikTok Intrigues |

| A potpourri of Silicon Valley intel around D.C.’s TikTok fight. |

| TEDDY SCHLEIFER |

|

|

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|