|

|

Welcome back to Dry Powder. I’m William D. Cohan.

By all appearances, the British Parliament is putting the kibosh on Jeff Zucker’s bid to take control of The Spectator and The Telegraph. But is all hope really lost? In today’s issue, a close look at RedBird IMI’s various exit options, plus a banker’s-eye view of Trump’s bond dilemma.

But first, an update on the Paramount Global sweepstakes, and a dispatch from wine country written by the peerless white shoe bar expert Eriq Gardner…

|

|

|

- Apollo has landed: As predicted, Apollo has made its move in the Paramount Global sweepstakes: an $11 billion bid for the TV networks, CBS and its local stations, plus the Paramount movie studio. Good for Apollo. It’s what David Ellison should have done months ago, instead of futzing around with trying to buy NAI, the Redstone family holding company. But now, the nightmare begins for the Paramount Global special committee of the board of directors.

To wit: Apollo’s $11 billion offer is $3 billion more than the entire equity of the company (although it’s about half the enterprise value of $21 billion, when the net debt is included). What’s a special committee to do with that offer? Jayzus.

Say the committee deems it fair and inks a deal with Apollo for those assets. Paramount Global gets $11 billion in cash, and then has to pay taxes on that windfall, at, say, around 25 percent, given the low basis in these assets. That would leave $8.25 billion for the company, which could be used to pay down debt (which would be smart). But then what? Shari would still have to sell what’s left—a hodgepodge of Paramount+ (which is bleeding money) plus BET plus some other forlorn cable channels and whatever else is left. The crown jewels will have been sold, leaving about $6 billion of debt and around $8 billion of equity.

I doubt that around $14 billion of enterprise value would make sense with those remaining assets. This is going to be a very tough call for the special committee and for Centerview Partners, its financial advisor, but it is absolutely the right strategy for Apollo. I suspect that while Centerview is digesting the Apollo offer, it will also be making impassioned calls to see who might pay more—or, better yet, make an offer for the whole thing.

I’ll have more analysis on Sunday. In the meantime, I’m grabbing the popcorn!

- War of the Rosés: If there’s anything that Elon Musk should have known before nixing his deal with Don Lemon, it’s that the absence of a signed, written agreement only ensures a messier legal showdown. Just ask Brad Pitt and Angelina Jolie.

As I’ve highlighted before, Pitt and ex-wife Jolie are locked in a War of the Rosés over Château Miraval, the picturesque estate and vineyard nestled in the French countryside. Following their split, Jolie offloaded her share to Stoli Group founder Yuri Shefler, a move that Pitt contends breached their agreement to seek each other’s consent before selling. Granted, this agreement was never put to paper, but that’s hardly stopped the courtroom drama. This past week, a judge ruled that Pitt had adequately pled the existence of an implied contract. Now comes the messier battle over whether their actions indeed formed a binding contract. Legal costs have already soared into the tens of millions of dollars. —Eriq Gardner

|

|

| Lord Zucker’s M&A Do-Over & Trump Bankruptcy Options |

| News and notes on two intoxicating bankruptcy restructurings: Jeff Zucker’s latest gambit to claw the Telegraph and Spectator away from the Barclays, despite the punctilious British regulators; and Trump’s high-stakes lawn sale. |

|

|

|

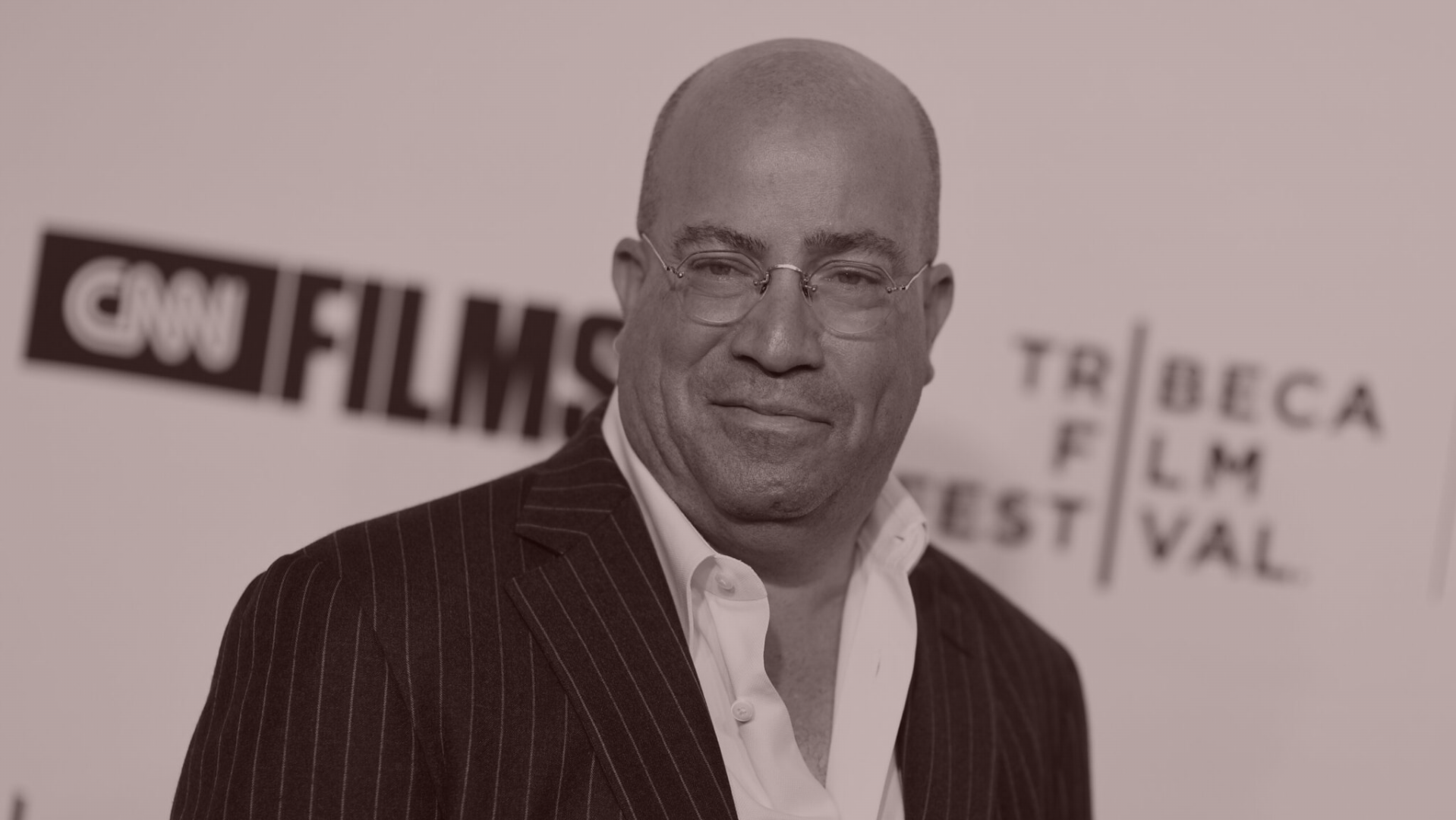

| By most objective measures, Jeff Zucker has had a pretty good run at RedBird IMI, his new private equity fund, following his exile from CNN. In the last year, since the formation of the partnership between himself, former Goldman banker Gerry Cardinale’s RedBird Capital, and Sheikh Mansour bin Zayed Al Nahyan, an Emirati royal, Zucker has committed some $1.6 billion to six deals, including an investment in Media Res, the Hollywood production studio founded by former HBO executive Michael Ellenberg, and it’s about to close a $1.45 billion deal for All3Media, the U.K. production company behind such hits as Fleabag and Squid Game: The Challenge.

Then there is Zucker’s other U.K. deal, the one for The Telegraph and The Spectator, which is not going nearly as well. It’s not official official yet, but it looks pretty certain that Parliament will be concocting a fast-tracked amendment to a current law, the spirit of which is to prevent any foreign government—or entity associated with a foreign government—from owning a British newspaper or magazine. And so while Zucker is still waiting for the precise language of the amendment, it’s likely that the gist of the new legislation will nuke his deal, since obviously the Sheikh is an Emirati royal and therefore is associated with a foreign government. Unfair, perhaps, but not all that dissimilar to the rule that prevents a foreign company from owning a U.S. broadcast network, or the proposed law that would require ByteDance to divest TikTok. Zucker and the deal team at RedBird IMI knew this was the dynamite stick in the deal all along—so no surprises here but still an unfortunate outcome for Mr. Zucker…

But the more I dig into the RedBird IMI/Telegraph saga, the less sure I am that this is the end of the line for Zucker on this deal. As you may recall, RedBird IMI vaulted itself into the catbird seat by initially choreographing a particularly clever M&A move that essentially froze the Goldman Sachs auction. Back in June 2023, the Barclay family, which owned the two publications, defaulted on £1.2 billion in loans owed to Lloyds, which put the publications’ holding company, the Bermuda-based B.UK., into liquidation as a result. In October, Lloyds put the two publications up for sale, with Goldman as the auctioneer.

The idea, of course, was to sell the publications for as much as possible, to recoup the money owed to the bank and maybe even generate a profit if the bidding turned sufficiently robust. But on November 20, RedBird IMI reached an agreement to provide loans to the Barclay family to pay off Lloyds in full. As part of the agreement, RedBird IMI received an option from the family to take control of The Telegraph and The Spectator, pending regulatory approvals, etcetera. The payoff to Lloyds came in two tranches: a £600 loan from the Sheikh to the Barclays themselves, secured by the assets of The Very Group, a completely separate online retailer owned by the Barclays; and another £600 million loan from RedBird IMI—this one secured by the assets of The Telegraph and The Spectator. In effect, Redbird IMI paid £600 million for the two publications.

Assuming RedBird IMI is prevented from owning the two publications, Zucker’s immediate focus, naturally, will be to recoup the loan secured by them. How does he do that? By putting the publications up for sale again and hoping that there’s enough of a bidding war to get the purchase price for The Telegraph and The Spectator above £600 million.

|

|

|

| I’m told that Zucker has received a lot of inbound interest since word came down that he probably won’t be able to buy the two publications. There was, after all, a fair amount of interest before RedBird IMI outfoxed the other bidders last year, and I’d expect the likes of Axel Springer or Lord Rothermere’s DMGT, the owner of the Daily Mail, to re-engage with a new sale process. There could also be serious interest from the likes of Rupert Murdoch or his son Lachlan, and Paul Marshall, the controversial British hedge fund manager. Zucker has also been hearing from investment bankers hoping to run the process, though I’m told he has not yet made a selection.

The chatter among media people was that RedBird IMI overpaid for the assets in order to bend the auction to their will. But that was mindless babble, and I think Zucker’s prospects for recouping RedBird IMI’s £600 million look pretty decent. The Telegraph generated around £60 million in EBITDA in 2023, so Zucker agreed to pay less than 10x EBITDA for the two publications—hardly an outrageous multiple for a rare prestige media business that is still making money and that has a loyal following, albeit in a smallish market. (Part of Zucker’s plan was to bring The Telegraph to the U.S.) Yes, Jeff Bezos paid only $250 million for The Washington Post, but it’s losing money. Patrick Soon-Shiong paid $500 million for the L.A. Times, but that is losing money too. So, it’s not crazy to think that RedBird IMI will recover its £600 million when the dust settles here. (The Sheikh’s £600 million loan to the Barclays is the Sheikh’s problem alone and has nothing to do with Redbird IMI.)

Indeed, if there’s a feeding frenzy of some sort, RedBird IMI could actually make money. Don’t forget, RedBird IMI is in the unlikely situation of controlling the sale process because it made a loan secured by the company’s assets. Had it not made that loan, it might not have won the Goldman auction, but it also wouldn’t have £600 million at risk now. As I say, it’s a very odd situation: I’m also hearing that the issue of who has the right to sell the publications is not quite settled—that the Barclays think they still do, or the directors appointed by Lloyds think they do—but my money is on Zucker, with Cardinale’s support, controlling the sale process. (A person close to this action confirmed to me that The Telegraph and The Spectator are Zucker’s to sell, which is why he is getting so many inbound calls from bankers and interested buyers.)

On the other hand, it’s also quite possible that the potential bidders will think that Zucker is a distressed seller and try to take advantage of him. They might try to lowball him and see if they can get the publications for less than Zucker paid for them. Will Zucker be forced to take it on the chin? Is it possible that his clever gambit to get the two publications by paying off the Lloyds debt at the eleventh hour could end up backfiring and RedBird IMI could be forced to take a loss on its £600 million?

I don’t think so. If the new auction goes awry and bidders try to take advantage of RedBird IMI’s forced sale, I think Zucker has another option. Recall that RedBird IMI is 25 percent owned by RedBird Capital and 75 percent owned by IMI, the Sheikh’s fund. Apparently, I’m told, the U.K. folks are not opposed to the Americans owning The Telegraph and The Spectator—it’s just the Sheikh’s money that makes them nervous. So if the bidders try to lowball, RedBird Capital could step up and buy out IMI’s 75 percent of the £600 million, for another £450 million, putting the loan 100 percent into the hands of the Americans. At that moment, RedBird could convert the loan to equity and end up owning The Telegraph and The Spectator, full stop.

I doubt this is Zucker’s—or RedBird’s—preferred strategy at the moment. But it is an option, and it’s probably a better option—especially in the first year of RedBird IMI’s existence—than getting crushed on the £600 million loan, which will materially diminish deal flow and Zucker’s reputation. So while all appears to be in flux with this acquisition at the moment, I would not be surprised if Zucker still ended up owning the two publications. And at that point, of course, he’ll have to work quickly with management to overcome the time lost during the approval process. Regardless, as a former Wall Street restructuring and M&A banker, I have to admit that I am enjoying these deal dynamics very much.

|

|

|

| I confess to also being mesmerized by the question of how Donald Trump will manage to avoid a forced sales process of his own, now that he’s admitted he’s not sufficiently liquid to post bond for the more than $500 million he owes to New York State. It’s all becoming quite meta: Trump was found guilty of manipulating the value of his assets, and indeed, his assets now appear to be worth much less than he claimed as he scrambles to find a bonding company willing to accept those assets as collateral. You can’t make this stuff up.

Apparently, Trump approached 30 different bonding companies, but came up empty. And that’s despite his claim, during his April 2023 deposition, that he and the Trump Organization had more than $400 million in cash on hand, and growing every day. That was… not true? Alas, Trump’s reputation for not paying back creditors and stiffing subcontractors and his lawyers has finally caught up with him. After all, if a bonding company takes a pledge of his assets in return for putting up the bond, and then Trump loses the appeal, it’s the bonding company that has to pay the judgment and then fight to recoup that money from Donald Trump. What underwriter in their right mind would take that risk? None that I know.

It’s not inconceivable, I suppose, that one of his rich buddies will come to his rescue. Elon Musk has said he’s out. But what about Larry Ellison, or his Palm Beach neighbor Ike Perlmutter, or any number of other extremely wealthy Trump enthusiasts? What about the Saudis? One of them, or several of them, could throw him a lifeline. And I’m sure he’ll be furiously exploring every one of those possibilities over the next week, until the March 25 deadline. In that case, of course, his guarantor would be in a position to extract from him all sorts of things—a suboptimal situation for a presidential candidate. But that would all probably run afoul of our campaign finance laws—as it very definitely should. So explore away, Donald, but I don’t see that happening either.

And if Trump can’t find the rescue financing he needs by Monday, and he can’t get either the lower court judge or an appeals court judge to grant him more time—still a possibility, I suppose—then I would expect Letitia James to start seizing his assets until the judgment is paid off. She’d start with his liquid assets, such as his bank accounts and brokerage account. Then she’d move on to his illiquid assets, particularly 40 Wall Street, which she’s already indicated that she’s focused on.

Who knows what a Class B office building in Lower Manhattan is worth these days? Not all that much, and certainly not the hundreds of millions that The Donald has declared. And talk about a distressed sale, where a buyer—if there even is one—will try to take advantage! And what about the debt on the building? (It’s not clear how much debt still exists on 40 Wall.) It’s quite likely, in any event, that the combination of his liquid assets and the equity in 40 Wall might not get the judgment paid.

What then? As I’ve suggested before, there is the equity he potentially has in Digital World Acquisition Corp.—the SPAC that is on the verge of acquiring Trump’s social media company, Truth Social, potentially giving him a windfall in the billions. He could give James this stock, I suppose. But that may not fly, either, considering the merger still has not been approved by DWAC shareholders and the SPAC and Truth Social face multiple lawsuits. So I guess James would then turn to what Trump still owns in Trump Tower, on Fifth Avenue, plus his golf courses, and then his Westchester estate and Mar-a-Lago. (He also has minority stakes in two Vornado-owned office towers, one in Manhattan, and one in San Francisco, but those can’t be sold without the cooperation of Vornado and I don’t see that happening.)

Finally, of course, there is always the personal bankruptcy option, which would stay that legal judgment but add a considerable layer of complexity to both his personal and political dramas. I think personal bankruptcy is Trump’s best option at this point, since it would delay him paying the New York State judgment and allow for a far more orderly sale of his assets. He has said he wouldn’t do it. But I bet he will, if the courts don’t cut him a break (and why should they?) “The going is likely to get rough for Trump as this plays out,” the dean of Trump watchers, Tim O’Brien, the senior executive editor at Bloomberg Opinion, wrote the other day, “and he’s likely to become more financially desperate with each passing day. That’s going to make him easy prey for interested lenders—and an easy mark for overseas interests eager to influence U.S. policy.” Regardless of how this goes down in the next week or so, it will be a well-deserved rendezvous with justice, and destiny, for one of the greatest con men of all time.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

| Netflix’s Endgame |

| A close look at Netflix’s savvy use of licensed content. |

| JULIA ALEXANDER |

|

|

| Reality Bites Bravo |

| Penetrating the lawsuits threatening the essence of reality TV. |

| ERIQ GARDNER |

|

|

| Pitaro Murmurs |

| News and notes on the Iger succession bake-off. |

| JOHN OURAND |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|