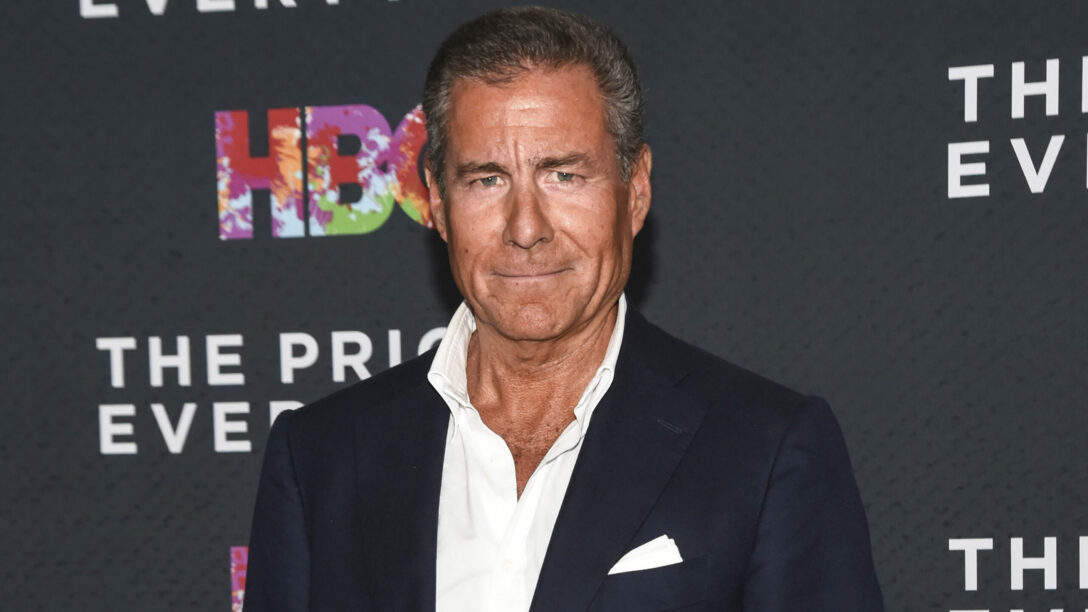

The Apple TV+ miniseries Black Bird is, at first glance, precisely the type of prestige streaming show that should have broken out from the get-go. The Mindhunter-like crime drama hails from acclaimed author Dennis Lehane and stars a hulked-out Taron Egerton, Paul Walter Hauser, and Ray Liotta in his last project before he tragically died earlier this year. Perhaps most notably, the series is executive produced by Richard Plepler, the legendary former HBO chief who launched Game of Thrones, among so many other genre-defining hits. That’s not a bad checklist.

There’s also a very good chance that, up until recently, or even just now, you didn’t know anything about Black Bird. Apple dropped the first two episodes on July 8, then moved to a weekly roll out. The finale drops this Friday, and while demand for the show has grown steadily, it didn’t really hit outstanding levels (2.7 percent of shows reach this tier) until July 22 globally and July 25 in the U.S., according to Parrot Analytics, where I work as director of strategy. Now, as buzz builds ahead of the finale, Black Bird is picking up speed and seemingly finding its audience. It’s the fourth most in-demand show on Apple TV+ right now, according to Parrot data. (Parrot Analytics combines consumption data with research, social media, and social video activity to determine cross platform demand for content in order to determine which series are most likely to drive subscription growth or retention.)