I’ve been thinking a lot these days about taxes and the celebrated art of tax avoidance. Disclosure: I have an accountant. He’s a professional with a license and everything, and he keeps me out of I.R.S. prison, also known as prison. I also have my own S-Corporation that I run my business out of. I’ve learned it’s far better to be a corporation in the United States than a human. You literally get more respect. I take what I consider to be reasonable steps to plan my taxes such as writing off business expenses and using tax-free retirement accounts.

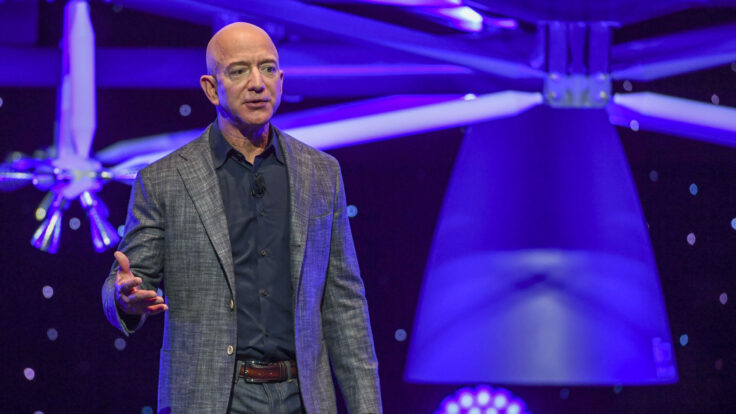

Of course, the wealthiest among us play by more esoteric rules. Earlier this summer, ProPublica got its hands on the tax records of 25 of the nation’s richest people, revealing their “true tax rate”—defined as federal income tax as a percentage of their net worth—of 3.4 percent. The basic and very legal scam is this: very wealthy people can deny themselves a traditional income. They pay themselves something symbolic like $1 per year, and they look like good allies to working people doing it. Then they use their investment assets to borrow the money that they actually live off of. The borrowing rates are far lower than the tax rates, and even the interest on these loans they get to write off on their taxes. I knew the system was rigged (Hi, Bernie!) but damn!